I try to save something on everything. And sometimes, I end-up saving everything on something. In this article, I will share all the credit card tricks that I use to save and explain how that help me make lacs of rupees.

Back in 2019, I wrote how I make thousands of rupees using credit card in which I explained 5 simple rules. While I still follow the same rules, this article is about how I’m saving and how much I’m making in 2021 with some new credit cards that I recently added to my wallet. You will see how these cards accelerated my savings from thousands to lacs per year.

What’s Changed from 2019?

Just a few, but has big impact on my total savings and how I select a card for a given spend category.

While I will explain how I’m utilizing all the cards that I’m holding at present, I will focus on the significant changes I’ve made in my previous strategy. That will keep the story short. Many figures and reward rates that I will be discussing here, are based on the previous article. So, I highly recommend reading that before reading this further. That is the foundation of my credit card tricks to make money.

Once you understand that, then this article will make better sense and you will be able to realize how the new cards boosted my earning from thousands to lacs.

Cards that are recently added to my wallet

HDFC Diners Club Black

HDFC has upgraded my Regalia First card to Diners Club Black. The annual fee remained NIL. I already explained (in Rule 4) how I had converted my Regalia First card to a Life Time Free card.

This super premium card has changed the way I used to use right card at right place (Rule 3). To realize that you also need to read my complete review of HDFC Diners Club Black card where I’ve discussed about it’s features and benefits in details.

As a result, some of my spends in shopping, utility bill payment and groceries have shifted towards this card.

Why? If you read my HDFC Diners Black complete review you would realize that it’s because of 10x offers on SmartBuy. When I can get returns like 33% then that should be my first preference, right?

I save Rs. 1 Lac on Rs. 3 Lacs spend

Even though there is a cap of 7,500 bonus Rewards Points per month, but that also makes 7,500 x 12 = 90,000 per year. For that, I only need to spend Rs. 3 Lacs on 10x category. With the conversion rate of Re. 1 per Rewards Point, when I combine the regular Rewards Points (which is 10,000 on 3L spend) with the bonus Rewards Points, then it comes to solid Rs. 1 Lac (33% return). So, my first 1L savings comes from here.

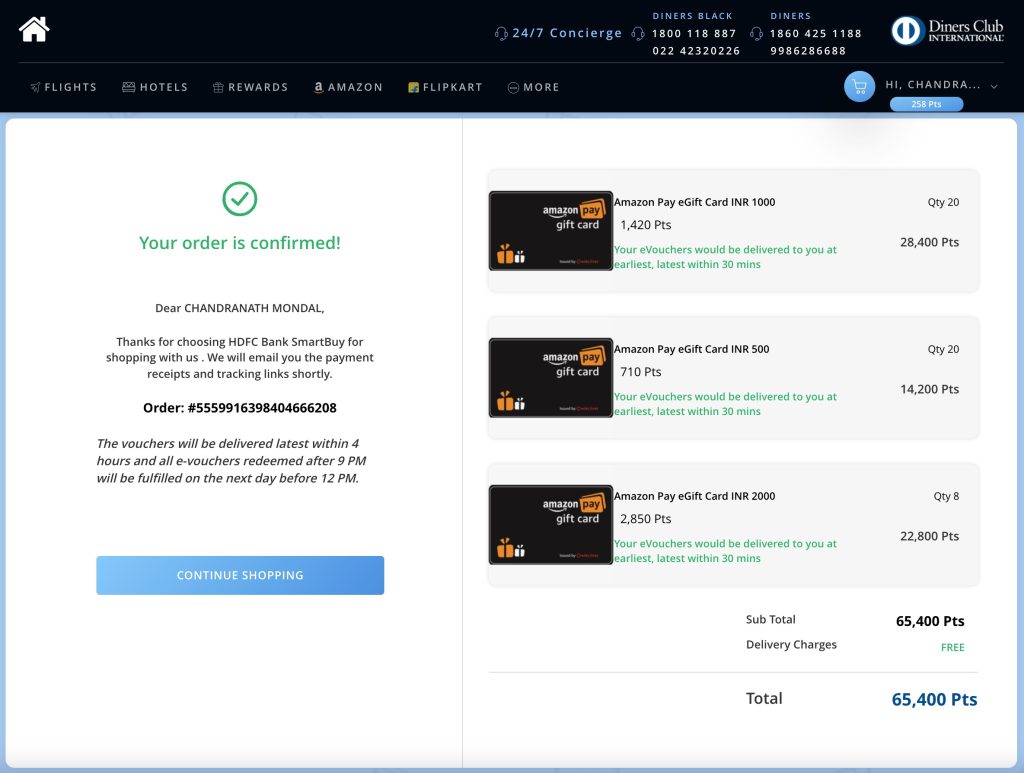

Recently, I redeemed 65,400 rewards points for Rs. 46,000 Amazon Pay gift card which translate to Rs. 0.70 per rewards point.

This justifies the title of this article, but there’s more!

With this card, I can enjoy free access to Airport lounges and Golf programs all over the world. That means, I literally save everything on something.

Fuel

Recently I purchased my first car, it introduced a new expense category to my monthly spends. I was searching for a fuel card and keeping an eye on ongoing offers (Rule 5). Then I found this Citibank offer for their IndianOil Card:

Get ₹ 3000 cash back on spends of ₹ 5000 in 60 days of card issuance

There are IndianOil outlets in my area, so my mind immediately said, “apply for this card“.

Citi IndianOil

This gives me 1% fuel surcharge reversal and 4 Turbo points per Rs. 150 spent. I can redeem 1 Turbo Point = Re. 1 of free fuel.

My annual fee of Rs. 1,000 will be waived off as my annual spending is going to be more than Rs. 30,000.

Travel

Till last year, I was completely dependent on Ola/Uber. So, I got a couple of cards specially for travel use.

Ola SBI

This card gives me 7% returns on my Ola spends.

But after purchasing my car, now I rarely use Ola and moreover I can get 33% returns from SmartBuy on Ola voucher. So, I will be closing this card before the annual bill cycle to avoid the Rs. 499 annual fee.

American Express SmartEarn

I used to get 10x rewards on Uber spends, which converts to ~4% returns.

I was offered to get this card as a complementary for holding American Express Membership Rewards card, so I don’t need to pay any annual fee. Hence, nothing wrong in keeping a card especially when it’s from American Express.

Yes Premia

My Yes Prosperity Rewards Plus card was upgraded to Yes Premia card. The annual fee remained NIL similar to my Prosperity Rewards Plus card, not sure if this was because later I opened a savings bank account with them.

There is no specific areas where I use this card, but Yes bank keeps running good deals where this card becomes useful. Moreover, it doesn’t cost me a single penny for keeping it idle.

Apart from that, it offers some exclusive benefits that I can enjoy for free:

- 25% discount on movie tickets booked on BookMyShow.

- Priority Pass Membership and 2 complimentary visits outside India in a calendar year.

- 2 Domestic Lounge access per quarter.

- Enjoy waiver of 4 Green Fee at select golf courses in India.

- Enjoy 1 complimentary Golf Lesson every calendar month at select golf courses in India.

- Credit Shield cover of INR 2.5 Lacs in case of accidental death.

Online Spends

Bank of Baroda Eterna

I already have my SBI SimplyCLICK card which I use for online spends. But, I found this card even better when it comes to online spends. It offers the best returns (3.75%) in select categories like online spends, dinning, and more. But I can accelerate the returns to ~5% on these categories.

I save ~Rs. 25K from home loan EMI payments

I got this card exclusively for paying my home loan EMIs. Didn’t believe? If you think it’s not possible to pay loan EMI with credit card, then you must read my exclusive article on how I made that possible with a simple trick.

When I discovered the trick, it introduced a new category of savings. Before that, I was paying my EMIs using bank ECS. But now, I can use this credit card to make those EMI payments and save sweet ~25K at the end of the year.

Cards that I’m continuing to use

American Express Membership Rewards

This card helps me aggregate small expenses to a big one (Rule 1), and gives me 10% returns just by 4 swipes each of Rs. 1,000 per month.

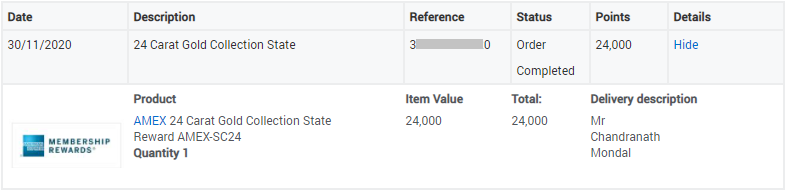

Recently, I redeemed 24,000 rewards points for Rs. 9,000 statement credit which translate to Rs. 0.37 per rewards point.

Also, American Express runs great offers throughout the year. It’s an amazing card to have in your wallet.

SBI SimplyCLICK

This card helps me convert offline payment to online payment (Rule 2) and earn 3.25% returns. But with the introduction of new SBI T&C where wallet recharges no more attract rewards points and my HDFC Diners Club Black giving higher returns compared to SBI’s regular online spends as well as some of the 10x partners, it was important to decide whether to continue using this card or not.

It definitely depends upon your spends, and I decided to continue using it. There are reasons behind that:

- Regular online spends still attracts 3.25% returns which is slightly lower than 3.3% (regular returns on my HDFC Diners Club Black). So, I can consider using my SBI card in those areas ignoring the little 0.05% profit.

- There are lot of places (like NPS contribution and rent payment) where transaction can be done using credit cards. As the return on this card is higher than the service charges in those areas, I can further save something on those payments.

- Each online spend counts and completing 1L spends makes my annual fee NIL. Instead of using my HDFC Diners Club Black, if I use this card for the regular 1L spends then I would only earn Rs. 50 (0.05% of Rs. 1L) less. This means, by sacrificing Rs. 50 annually I can keep this card.

- Lucrative offers go on in both online and offline for SBI Credit Card customers, and I can easily avail those offers.

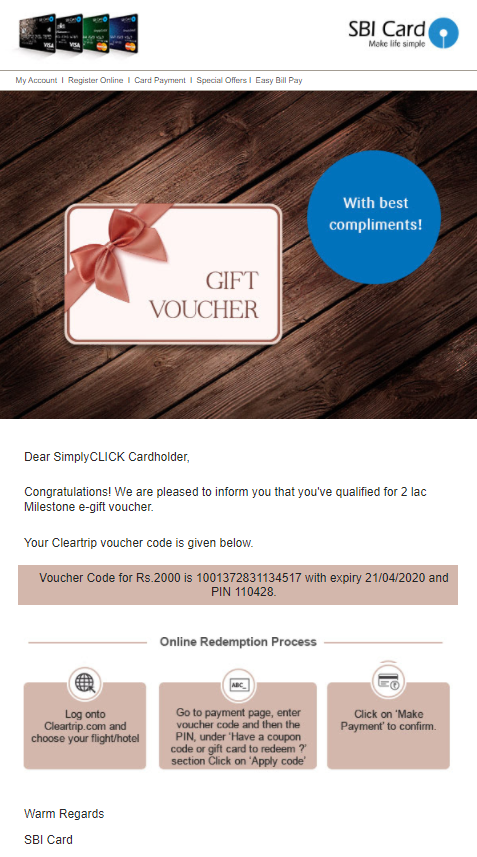

Moreover, who doesn’t love Cleartrip voucher.

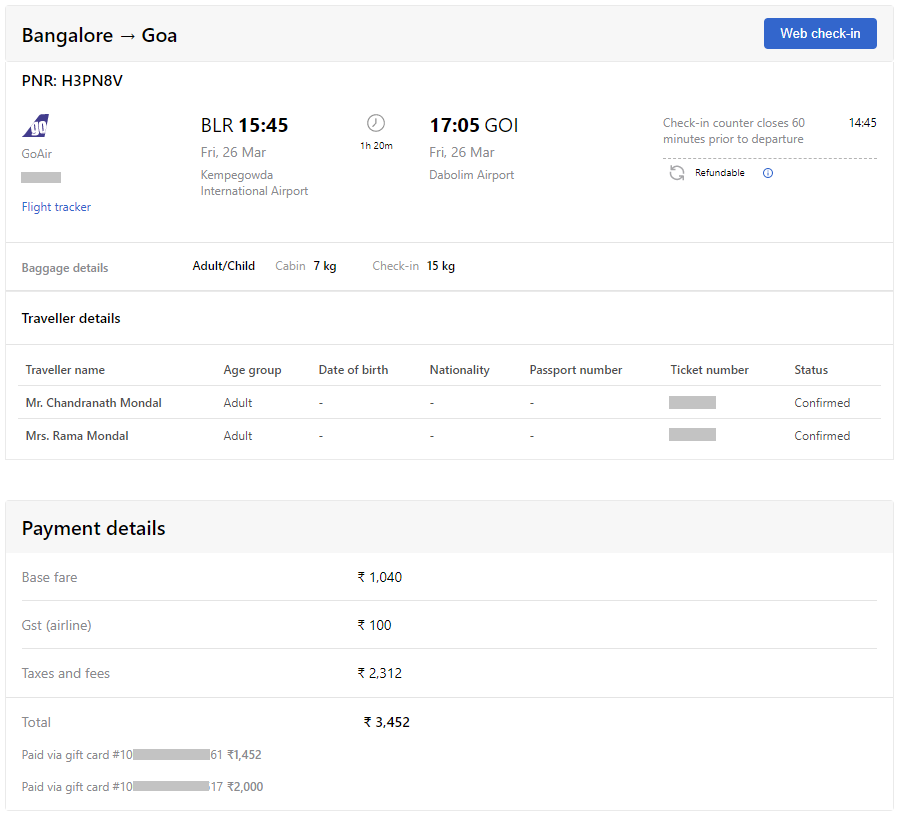

Recently, I booked my Goa trip entirely with the Cleartrip milestone vouchers.

Utility Bill Payments

Citi Cash Back

Citibank Cash Back is my first credit card and it was offered as complimentary (no annual fee) with my salary account. It gives me 5% returns in the form of cashback.

Groceries

Standard Chartered Manhattan Platinum

I use this card in supermarkets to grab 5% cashback. Monthly Rs. 10,000 spends on this card gets annual fee (Rs. 1,000) waived-off.

HSBC Platinum

This is a free card with no joining or annual fees. I kept it just like that for grabbing occasional deals.

MakeMyTrip ICICI Platinum

This card comes with no annual fees and many good deals go on on ICICI cards.

There are some other benefits:

- Spending Rs. 5,000 in a calendar quarter makes you eligible to avail 1 complimentary airport lounge access in the next quarter.

- 1 complimentary railway lounge access in a quarter.

So, it’s worth keeping the card.

Card that I stopped using

As I get 3.3% default returns on my HDFC Diners Club Black card, some of my cards makes no significant difference when it comes to savings.

Shopping

I’ve closed Citibank Rewards card. There is almost no spend on that card so it doesn’t make any sense to pay Rs. 1,000 annual fee as long as I already have another Citibank card for grabbing occasional deals.

Bottom Line

Many people refrain from using credit cards as they end-up overspending. But if you know how to control overspending and make right use of your cards then you can save a lot.

If you make timely payments of your credit card dues then you gradually build good credit report which can help in the long run. For example – my credit score is more than 800 which made me eligible to get my car loan at the cheapest interest rate of Rs. 7.3% per annum.

Pro-Tips

Apart from that, there are many other benefits that come with credit cards and I can enjoy lot of exciting offers all over the world!

Which cards are you using in 2021? Any thoughts on this article, please leave your comments below.

![Credit Card Tricks: How I Make Lacs of Rupees [2021]](https://urbancodex.com/wp-content/uploads/credit-card-tricks-2021.jpg)

This is awwwesoomee post!!! that opened my financial eyes to enlightenment.

Awesome write-up, know your credit card well… KYCC… 👍