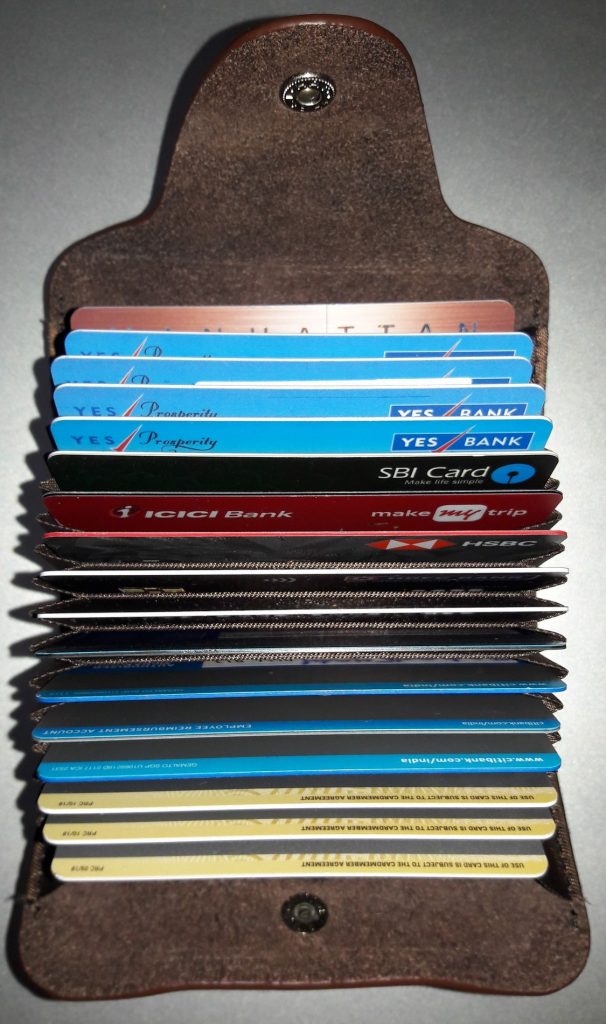

I use credit cards for almost all of my purchases. Today, most of the merchandise have partnered with selected banks where you get very good deals for using their credit cards and you can save some money.

Apart from saving money, there are lot of other benefits of using a credit card. I’ve written an exclusive article on why you should have a credit card. Currently if you are not using any credit cards, I highly recommend to go through the article.

I’ve seen many people end-up with overspending on their credit card, so they stop using it. If you are also finding it difficult to control your expenditure on your credit cards, then I highly recommend to read my another article to learn how to control credit card expenditures and stop overspending. I’ve shared my tips that I follow to avoid overspending.

I make my spends very carefully. I don’t spend more to save a little, rather I find better ways to spend so that I can save more. Mostly, I try to convert cash payment into card payment unless cash payment is giving me a better discount. You need to apply little tricks. Here I’ll share all those tricks that I follow. I hope that will help you as well to save that extra bucks.

Rule 1 : Aggregate small expenses to a big one

Do you spend Rs. 4K per month? Your spends may include anything like shopping, bill-payment, recharge, fuel etc. Today, everywhere you can use cashless methods for making your payments. Instead of making those payments by cash or debit card, how about using any electronic payment method like Paytm and saving more than Rs. 400 (which is 10%) per month? All you have to do is recharge your wallet 4 times with Rs. 1,000 (big expense) using your credit card and then pay from your wallet (towards small expenses) as and when required.

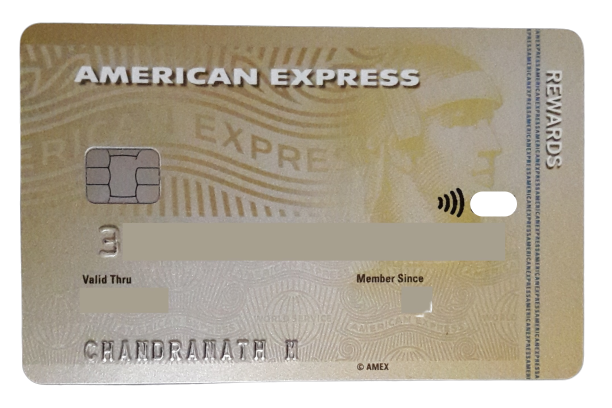

American Express Membership Rewards Credit Card

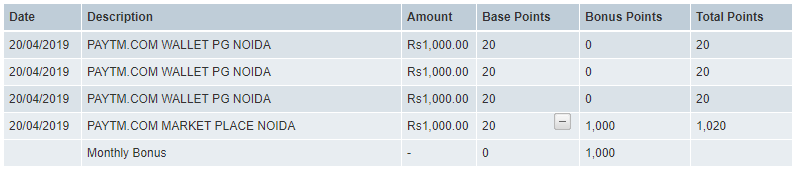

Just by seeing the name American Express if you think it’s going to be very costly, then wait. You can get the card absolutely free for the first year using my referral link. In a month, if you make only 4 transactions each of Rs. 1,000 or more then you can easily earn 1,080 (1,000 bonus + 80 regular) Rewards points. Following is a screenshot of my monthly Rewards points summary:

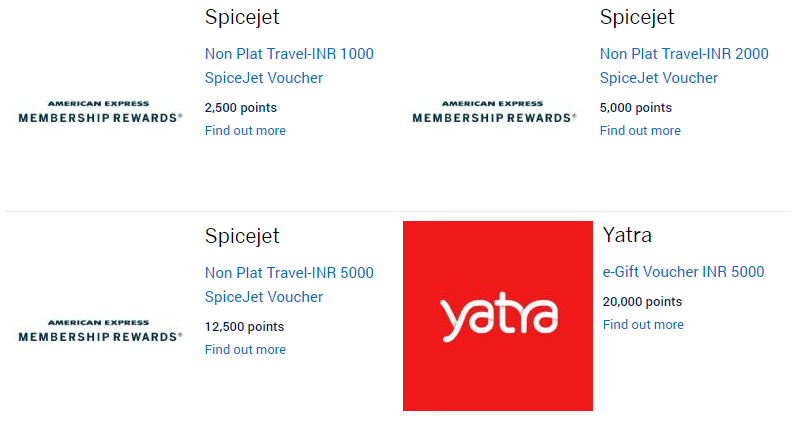

These points can be redeemed across varieties of online and lifestyle spends. Depending upon the option you choose, you can get higher conversion rate like 1 Rewards point = Rs. 0.62. But my favorite is travel voucher where I can get 1 Rewards point = Rs. 0.40.

So, monthly 4 transactions give you 1,080 Rewards points which is equivalent to Rs. 0.40 x 1,080 = Rs. 432. This is 10.8% savings on total spend of Rs. 4K. Which other card gives you similar benefit?

Read American Express Membership Rewards Credit Card Review to know about exciting benefits like joining rewards, referral rewards and many more. I’ve also explained how to easily earn 22,220 Rewards points in the first year. Multiply 22,220 by Rs. 0.40 and calculate how much you can make in the first year. It’s Rs. 8,888!

If you use my referral link, from second year onward a discounted annual fee of Rs. 1,500 (original fee is Rs. 4,500) is charged. Read American Express Membership Rewards Credit Card Review where I discussed how to get your annual fee waived-off and how you can easily make at lest Rs. 3,684 per year even after paying the annual fee just by spending Rs. 4K per month.

Rule 2 : Convert offline payment to online payment

When you swipe your card for regular purchases you hardly save anything. I’m not talking about spending at reputed brands like Big Bazaar, Amazon etc. I’m talking about your regular expenditures e.g. a local grocery store where merchants are not partner to credit card companies. There you earn ~0.5% or less on your total bill amount if you pay by debit card or any credit cards. Let’s see how you can increase the savings to ~4% of your total bill amount.

SBI SimplyCLICK Credit Card

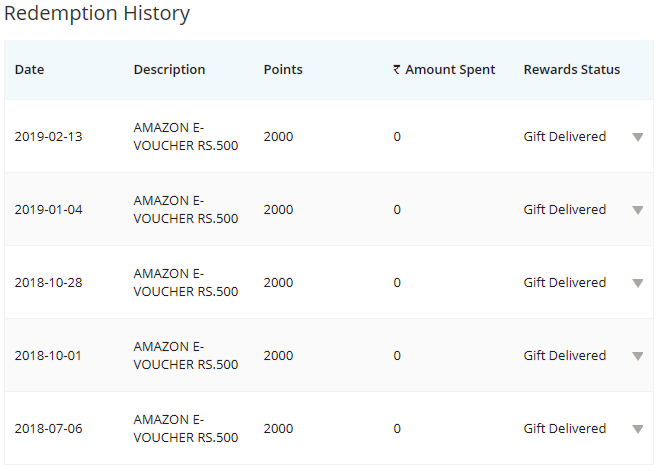

This card is amazing for online shoppers. But I love this card not only for online shopping but to use for many other purchases where I get an electronic way of payment e.g. e-wallet like Paytm. Instead of making a payment by swiping your credit card, if you recharge your e-wallet and make the payment from the e-wallet then you can earn 5x Rewards points. You can redeem these points across varieties of online and lifestyle spends. But my favorite is Rs. 500 Amazon E-Gift Voucher for 2,000 points because with that I can do whatever I want. This gives me 1.25% savings. Following is a summary of my last few redemption:

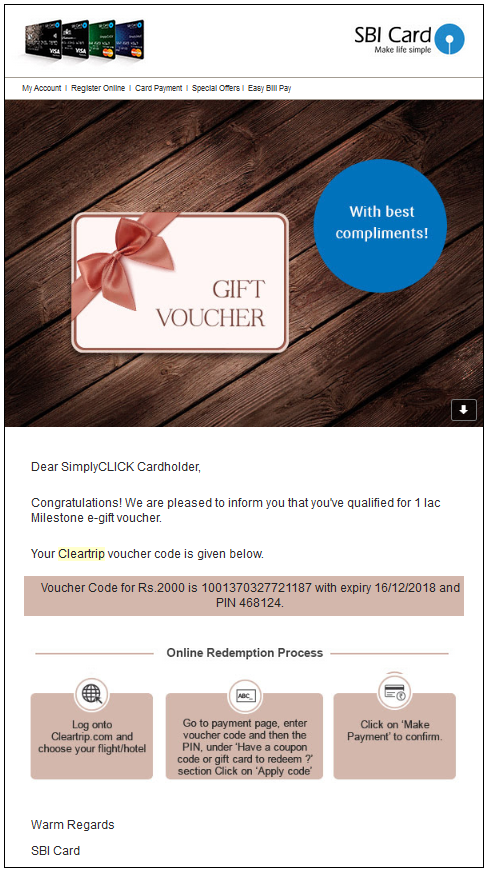

Along with that, I earn 2 Cleartrip vouchers each of Rs. 2,000 as milestone rewards when my annual spend crosses Rs. 1 Lac and Rs. 2 Lac respectively.

If you calculate Rs. 2,000 per Rs. 1 Lac spend, it’s 2% return. Along with 1.25% saving from Rewards points, your total return become 3.25%.

If you spend at selected merchants like Amazon, Cleartrip and there are few more, where you can earn 10x Rewards points which is 2.5% return. In that case, along with your 2% milestone bonus your net return becomes 4.5%.

I use this card for regular purchases as well as at selected merchants, so I make around 4% on average. My annual spend crosses Rs. 1 Lac, so I get Rs. 500 annual fee waived-off also.

If you are interested, you can apply for the card on their official website.

Rule 3 : Use right card at right place

Each credit card comes with it’s own set of benefits. If you carefully select the right card for your spends, it gives you better savings.

Shopping

A portion of my spends is made on apparel and at departmental stores. Let’s see what I do for that.

Citi Rewards Credit Card

I get 10x Reward points for every Rs.125 spent at apparel, department stores and select partners. You can also get 5x Rewards points for loading every Rs. 125 to Paytm wallet. This Rewards points can be redeemed across multiple channels.

Apart from that, I get good deals on travel tickets, discount offers from leading e-commerce sites and many more. I get Rs. 1,000 annual fee waived-off just by making Rs. 30K annual spend.

Use my referral link to apply for the card and enjoy many other exciting benefits. You can read my article Citi Rewards Credit Card (India) Review to know more.

Utility Bill Payments

I’ve several utility bills – postpaid mobile, data-card, landline phone, electricity which I need to pay monthly.

Citi Cash Back Credit Card

I got this as a complementary card for having my salary a/c at Citibank. So, there is no annual fee for me. On top of that I get 5% cashback on all bill payments and movie ticket purchases. Also, you can get flat 0.5% cashback for all other spends.

But keep an eye on ongoing utility and bill-payment offers from other vendors. This is very popular area where different card companies target throughout the year. So you might get even better offer. For example – currently Standard Chartered is offering 10% cashback for next 6 months and I’ve already registered for it. After 6 months if I don’t see any similar offers, then I will switch back to Citi Cash Back where 5% cashback is anyway secured.

You can apply for the card using this link. To know more details about the card, read Citi Cash Back Credit Card Review.

Groceries

Like everybody else, every month I also spend on groceries and I have a dedicated card for that.

Standard Chartered Manhattan Platinum Credit Card

This is the only credit card which gives 5% cashback on your grocery spends. There are many other benefits like Rewards points, discounts at many retail and outlets along with travel sites. But I mainly use it for my spends on supermarkets.

But there is a catch. The 5% cashback is capped to Rs. 150 per transaction and Rs. 500 per month. So, if you make any transaction of Rs. 3,000 or more then your cashback is limited to Rs. 150. So, here is what I do.

For my supermarket bill say of Rs. 5000, instead of making one transaction I rather ask to do two (in this case) transactions of Rs. 3,000 and Rs. 2,000. Thus, instead of getting limited cashback I get full Rs. 250 cashback (Rs. 150 from first transaction and Rs. 100 from the second).

Pro-Tips

This card comes with an annual fees of Rs. 999 but if your annual spends is more than Rs. 1,20,000 then that gets waived-off. Even if your spends is not that much, think about how you can save. For example – if you spend Rs. 5,000 per month then your total savings is Rs. Rs. 250 x 12 = Rs. 3,000. If you deduct annual fees, then your net annual savings is still more than Rs. 2,000 which is more than 3% savings.

If you are interested, you can apply the card on their official website where you can get Rs. 2,000 BookMyShow voucher on your first transaction.

Rule 4 : Find better way to get annual fee waived-off

Most of the credit cards come with an annual fee. Most of them also waive-off the fee if you meet any of their criteria like annual spend more than a certain value. But if you have multiple credit cards, then your annual spend on each of those cards may not cross the respective amounts. At the end, they charge you annual fee.

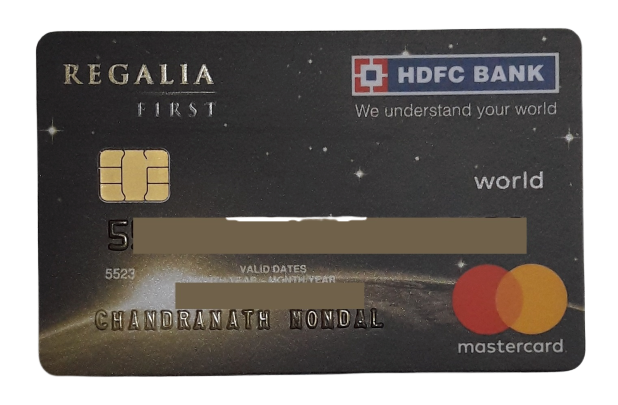

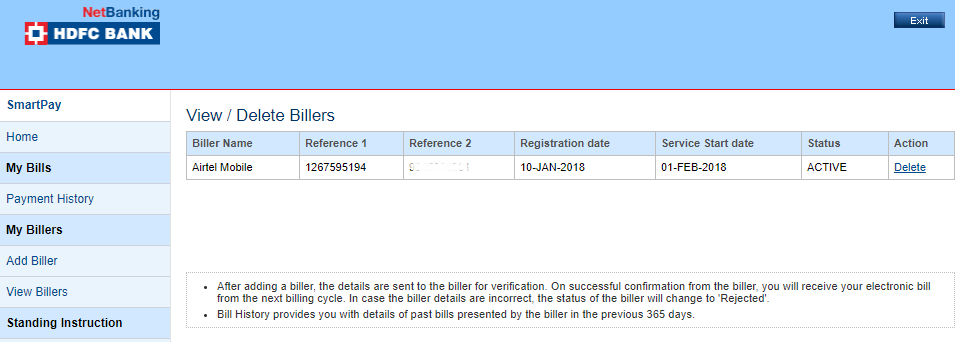

HDFC Regalia First Credit Card

This is a semi-premium credit card which comes with an annual fee of Rs. 1,000. But there was an offer where I enrolled for auto-bill payment of one of my utility bills and they converted my card to a life-time free card.

There are lot of benefits from Lounge Access to attractive Forex Markup fee which you get on this card. To apply for this card, visit their website and click on apply online.

Rule 5 : Keep an eye on ongoing offers

There are many credit cards in the market and all are trying to attract more and more customers. There are already lot of competition, and you will always find fantastic deals from different credit card companies. If you keep any eye on all those offers, and do a little research before making any spends, then you will definitely get a good discount on your purchase.

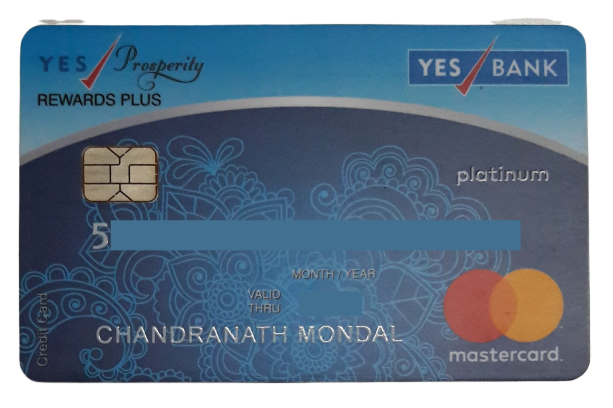

Yes Prosperity Rewards Plus Credit Card

This card comes with a Renewal Membership Fee of Rs. 350 however they offered me for free. Usually you can also get it for free.

It’s a beginner card with a varieties of options to earn Rewards points. But I like this card mostly because Yes Bank runs good deals once in a while where you can save a lot.

For making 4 transactions each of Rs. 500 in a particular month, I got this Rs. 500 BookMyShow voucher. That was a 25% return for me. Yes Bank runs this kind of offers through the year which is really amazing!

If you are interested, then visit their official website and apply online.

HSBC Platinum Credit Card

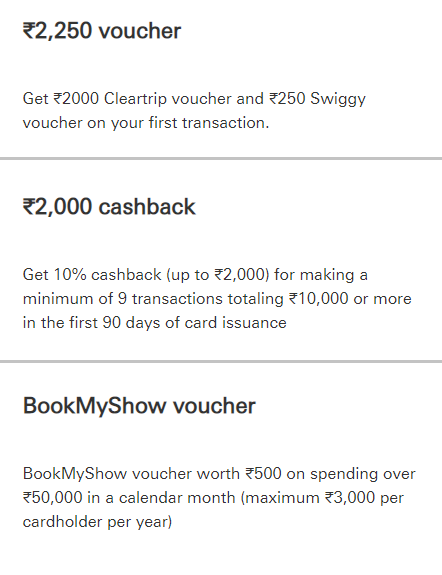

This card comes with no joining and annual fees. On top of that, HSBC offers plenty of introductory offers.

The first offer caught my attention where I just had to make one transaction (of any amount) to be eligible for Rs. 2,000 Cleartrip voucher. Amazing!

If you are interested, then visit their official website and apply online.

MakeMyTrip ICICI Platinum Credit Card

This card comes with Rs. 500 joining fee but you get MakeMyTrip My Cash of the same amount which is 100% usable. This makes the effective joining fee nil. There is no annual fee on this card.

It also offers a couple of complementary vouchers which attracted my interest.

1. Complimentary voucher for MMTBLACK membership

2. Lemon Tree Hotels voucher worth Rs. 2,000

Along with these, there are some other benefits on the card.

1. You can enjoy domestic airport and railway lounge access

2. You can save up to Rs. 6,000 with BookMyShow Buy 1 Get 1 Offer

If you are interested, then visit their official website and apply online.

I hope these tips will help you better use your cards and save more. Feel free to share your thoughts in the comments below.

![Credit Card Tricks: How I Make Lacs of Rupees [2021]](https://urbancodex.com/wp-content/uploads/credit-card-tricks-2021-300x200.jpg)

Bro, you are a pro in credit card spending.

Thanks Kavin!