Bank of Baroda (BoB) has recently introduced it’s premium credit card Eterna. Even though BoB is not so popular in the credit card industry, but I was surprised when I found that this card offers the highest rewards rate on select categories like dining, online shopping and more. Here’s everything that you would like to know about this card.

Experience

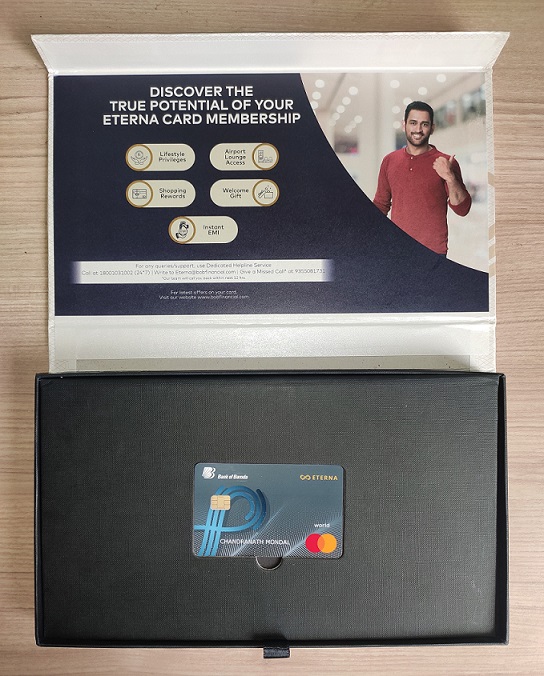

Very recently, I got this card.

It comes inside a beautiful box. The packaging is great, it’s even better than that of HDFC Diners Club Black card which is in super premium segment.

Inside the box, you get your credit card along with the welcome kit.

Eligibility

Salaried/Self-Employed with an income of ₹ 12 Lakhs per annum or more.

Fees

- Joining fee – ₹ 2,499+GST, waived-off on spending ₹ 25,000 within 60 days of card issuance

- Annual fee – ₹ 2,499+GST, waived-off on spending ₹ 2.5 Lakhs in the previous year

Features & Benefits

Accelerated Reward Points

15 reward points for every ₹ 100 spent on dining, domestic & internal travel and online spends.

Reward points can be redeemed @ 1 reward point = ₹ 0.25. This means a hooping 3.75% returns on your spends in these categories.

Core Reward Points

3 reward points for every ₹ 100 spent on any other category.

Milestone Rewards

- 10,000 bonus reward points on spending ₹ 50,000 within 60 days

- 20,000 bonus reward points on spending ₹ 5 Lakhs in a year

This gives you additional 1.5% returns in the first year, and additional 1% return from second year onwards.

Best Returns

If you spend ₹ 5 Lakhs in the accelerated reward categories, you can get:

- 5.25% returns in the first year

- 4.75% returns from second year onwards

This is the best return you get on this card which stands out in the competition.

Pro-Tips

There’s an upper limit of 5,000 bonus rewards per month that you can earn. For every ₹ 100 online spends, you get 3 core reward points and 12 bonus reward points. To maximize the benefits, you need to spend ₹ 5 Lakhs per annum which comes to ₹ 41,667 per month. And, this exactly gets you 5,000 bonus reward points per month.

I got his card exclusively for making my home loan EMI payments. So, I will be easily reaching ₹ 5 Lakhs milestone, and will be saving ₹ 26,250 in the first year & ₹ 23,750 from second year onwards.

Other Benefits

Dining Experiences

Relish 250+ culinary deals at Mastercard priceless specials. Click here to know more.

Hotel/Resort Booking

Unwind at luxury hotels & resorts in association with Mastercard priceless specials. Click here to know more.

Movie Tickets

Buy one get one (BOGO) movie ticket at Paytm Movies; upto ₹ 250 per card per month.

Fitness & Frolic

FREE 6 month’s FitPass Pro membership worth ₹ 15,000 as Welcome Gift. Click here to know more.

Golf Program

Tee off at prominent golf courses in association with Mastercard priceless specials. Click here to know more.

Domestic Airport Lounge Access

Enhance your airport experience with unlimited complimentary access at domestic airport lounges. Click here to know more.

Fuel Surcharge Waiver

1% fuel surcharge waiver at all fuel stations across India on transactions between ₹ 400 and ₹ 5,000 (Max. ₹ 250 per statement cycle). But, no Reward Points are earned on fuel transactions.

In-built insurance cover

Get free Personal Accidental Death Cover to ensure financial protection of your family (Air: 1 Crs, Non-Air: 10 Lakhs).

Forex markup Fee

Savings on international spends with reduced Forex mark-up of 2%.

Zero liability on lost card

Report loss of card immediately to ensure zero liability on any fraudulent transactions.

Bottom Line

Undoubtedly, this card is one of a kind. With the increase of online spends in today’s world, this card is something one must have because of it’s highest returns in the online category. And premium feature like free lounge access makes this card also very attractive to travel enthusiasts.

Are you using Bank of Baroda Eterna Credit Card? Feel free to share your experiences in the comments below.

![Bank of Baroda Eterna Credit Card: The Complete Review [2021]](https://urbancodex.com/wp-content/uploads/bank-of-baroda-eterna-credit-card.png)

![American Express Membership Rewards Credit Card: The Complete Review [2019]](https://urbancodex.com/wp-content/uploads/American-Express-Membership-Rewards-Credit-Card-300x190.png)

![Citi Rewards Credit Card (India): The Complete Review [2019]](https://urbancodex.com/wp-content/uploads/Citi-Rewards-Credit-Card-300x189.png)