American Express is well known for their world class customer service, low interest rate and security. American Express Membership Rewards (in short, AMEX Membership/ AMEX Rewards) is a beginner level premium credit card which comes with amazing features and benefits. It offers attractive reward points which can be redeemed for tempting gifts and exciting benefits. Along with that, their incredible offers at various travel and lifestyle partners make the card super popular.

Eligibility

There are eligibility criteria for American Express Membership credit card:

- For salaried employees, annual earning to be Rs. 4 lakh or more

- For self-employed, annual earning to be Rs. 6 lakh or more

Are you meeting any of these criteria? Congratulations! You can be a proud holder of American Express Rewards credit card.

Fees

AMEX Membership Rewards card generally comes with fees, but there is a catch.

- Joining fee – NIL (if you use a referral link from any existing card holder like me, otherwise you need to pay Rs. 1,000).

- Annual fee – Second year onwards Rs. 1,500 (if you use a referral link, otherwise Rs. 4,500). Your annual fee is 100% waived-off for making annual spend of Rs. 1,50,000 and 50% waived-off for annual spend between Rs. 90,000 to Rs. 1,49,999.

Thinking about the annual fee? Let’s see what all benefits you get from the card then you’ll realize that the annual fee is worth paying.

One-time Benefits

Welcome Gift

If you are not applying the card via any referral link, then you get 4,000 Rewards points in the 1st year on payment of the Joining fee of Rs. 1,000 and on spending of Rs. 2,000 within 60 days of cardmembership. 1 Rewards point = Rs. 0.40 (approx).

But if you apply via any referral link then not only your joining fee is waived-off, you also get 2,000 Bonus Rewards points on spending of Rs. 25,000 within the first 90 days of Cardmembership. Along with that, from second year onwards your annual fee becomes Rs. 1,500 (instead of Rs. 4,500).

Referral Bonus

Only if you apply via a referral link then you can get 2,000 Rewards points on spending Rs. 5,000 within the first 90 days of Cardmembership.

Benefits of applying via referral link:

1. Joining fee becomes Zero (instead of Rs. 1,000)

2. Annual fee becomes Rs. 1,500 (instead of Rs. 4,500)

3. Get 4,000 bonus Rewards points (2,000 Welcome Gift + 2,000 Referral bonus) for spending Rs. 25,000 within first 90 day of cardmembership.

Pro-Tips

On Standing Instruction

You can get 1,000 Rewards points on setting-up standing instruction to pay your utility bill within the first 150 days of Cardmembership.

On Supplementary Card

You can apply 2 supplementary (add-on) cards for your family members at no additional costs. You can also earn 2,000 Rewards points per add-on card.

All Time Benefits

Rewards Points

- 1 Membership Rewards point for every Rs.50 spent.

- 1,000 Bonus Membership Rewards points for using the card 4 times in a month for transactions of Rs.1,000 or more.

- Membership Rewards® Points never expire.

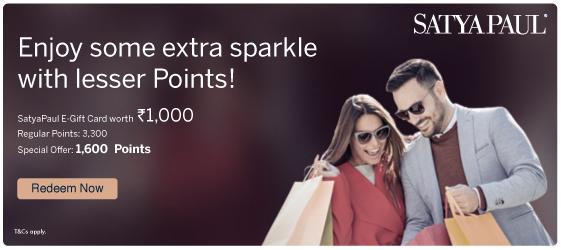

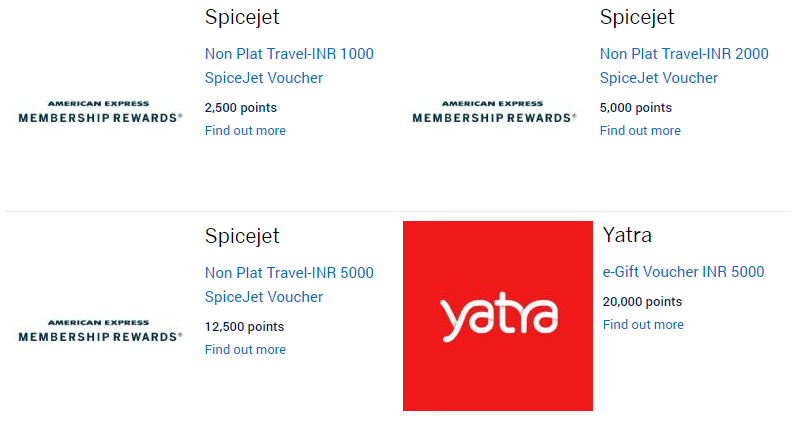

Rewards Redeemption

- Rewards points can be redeemed across various online and lifestyle spends. Depending upon the option you choose, you can get higher conversion rare like1 Rewards point = Rs. 0.62.

- My favorite is SpiceJet travel voucher where I get 1 Rewards point = Rs. 0.40.

- 18,000 Rewards points can be redeemed for 18 Karat Gold Collection – cash credit of Rs.7,500 or Amazon gift voucher worth Rs.8,000 and Tanishq gift voucher of Rs.7,500.

- 24,000 Rewards points can be redeemed for 24 Karat Gold Collection – American Express domestic travel online voucher worth Rs.11,000 or Bose Soundlink Color II Bluetooth speaker or cash credit of Rs.10,000.

Low EMI Interest Rate

Enjoy low interest rate of 1.17% per month on your purchases of Rs. 5,000 or more when you convert it to monthly EMI. There is no foreclosure charges, while most other cards charge about 2% to 3%. This gives a decent amount of savings and flexibility to close your EMI anytime.

Pay with Rewards Points

Use Rewards points to pay for flights, hotels and shopping. So, you are not bound to purchase gifts and vouchers only from their collection. This gives you freedom to use your rewards points at your convenient place.

Fuel Convenience Fee Waiver

Enjoy 0% Convenience fee on fuel purchase at HPCL for transaction less than Rs. 25,000 and 0.3% Convenience fee on fuel purchase per transaction is applicable for all transactions on and above Rs. 25,000.

Enjoy 20% Off on Dinning

You can enjoy up to 20% off every time you dine at select restaurant partners. Here is the complete list of restaurants in India where you can get this discount.

Exclusive Benefits

Zero Lost Card Liability

This is the most amazing feature of AMEX and a key differentiating factor. If there is any fraudulent transactions made with your card, your liability will be NIL if the fraud is reported within three days. If the fraud is reported after three days, your liability will be a maximum of Rs. 1,000. In such cases, AMEX will cancel the transactions.

Emergency Card Replacement

If you lose your Card, get it replaced within 48 hours wherever you are in the world. So, this can be a great help for you when you are away from your own city or country.

Amex Pay – Pay your own way

Are you a tech savvy? Then register for Amex Pay to start making QR code-based or contactless payments right from your Android devices.

ezeClick Powered by SafeKey®

Improve the checkout experience by simply entering the ezeClick ID and one-time-password (OTP). This significantly improves your checkout experience that too with complete security.

Airport Lounge Access

Enjoy discounted access to more than 30 Domestic lounges in India.

Pro-Tips

First Year Savings 14.5% : Rs. 8,888 on spending of Rs. 61,000

- Make 4 transactions per month each of Rs. 1,000. This will give you 1,080 Rewards points per month for spending only Rs. 4,000. So, you get 1,080 x 12 = 12,960 Rewards points in the first year.

- Along with Rs. 12,000 spend in the first 3 months, if you make additional Rs. 13,000 spend within first 90 days then you will get 13,000 / 50 = 260 regular Rewards points. Along with that, you also get 2,000 Rewards points as Welcome Gift and 2,000 as Referral bonus (only if you apply via any referral link). So, you can earn total 4,260 Rewards points.

- Apply 2 supplementary cards for your family members which don’t have any additional burden. This will get you 4,000 Rewards points.

- Opt for standing instruction within the first 150 days to pay any of your utility bills. This will get you 1,000 Rewards points.

- Altogether, you can earn 12,960 + 4,260 + 4,000 + 1,000 = 22,220 Rewards points in the first year which comes to 22,220 x Rs. 0.40 = Rs. 8,888.

- Your total spend throughout the year is Rs. 48,000 + Rs. 13,000 = Rs. 61,000 and you save Rs. 8,888 which is 14.5% savings.

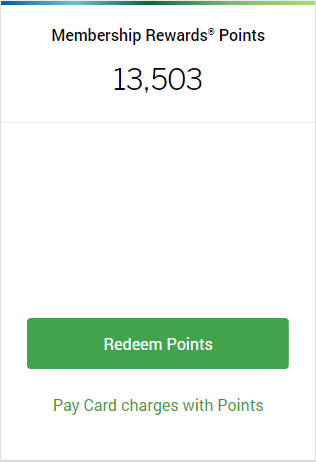

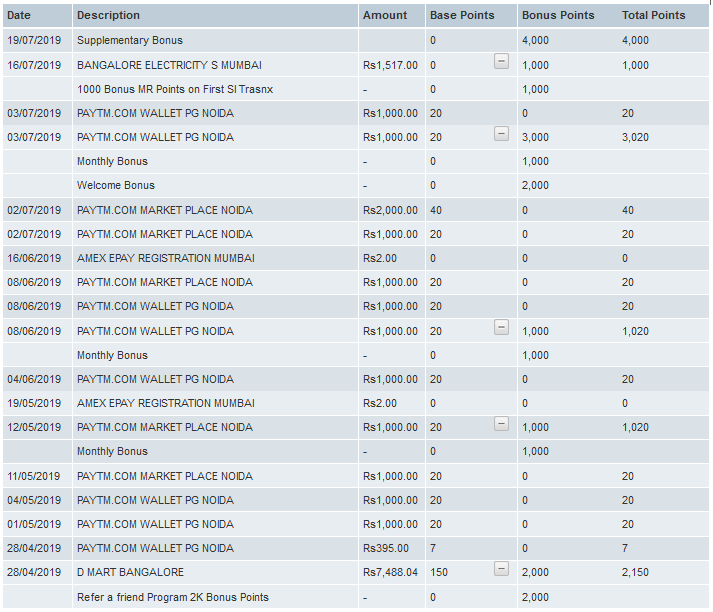

I earned 13,500 Rewards points in the first 3 months

13,5000 Rewards points are worth Rs. 5,400 (13,500 x Rs. 0.40). My total spend was only Rs. 25,000 to earn these points.

I’m explaining how I did that.

- I activated my card in the middle of April. So, I’m completing 3 months in the middle of July. I got 4 calendar months.

- I spend 4 times of Rs. 1,000 in each of April, May, June and July. This way I got 1,000 x 4 = 4,000 monthly bonus Rewards points.

- Along with this Rs. 4,000 x 4 = Rs. 16,000 spent, I also spent around Rs. 9,000 more to meet Rs. 25,000 spends. This earned me 25,000 x 0.02 = 500 regular Rewards points.

- I applied my card via referral link, so first Rs. 5,000 spend gave me 2,000 Rewards points along with Rs. 25,000 spend gave me another 2,000 Rewards points. So, the referral helped me getting 4,000 Rewards points in total.

- I opted for standing instruction to pay my electricity bill. This gave me 1,000 Rewards points. I cancelled it after first month’s bill payment.

- I applied 2 supplementary cards at no extra cost for my family members. This gave me 2,000 x 2 = 4,000 Rewards points.

So, total earning is 4,000 + 500 + 4,000 + 1,000 + 4,000 = 13,500 Rewards points.

Second Year Onwards Savings 7.6% : Rs. 3,684 on spending of Rs. 48,000

- Similar to the above, 4 transactions per month each of Rs. 1,000 get you 12,960 Rewards points per year.

- This gives you 12,960 x Rs. 0.40 = Rs. 5,184.

- Even if you don’t spend much and they charge you annual fee of Rs. 1,500, you still can save Rs. 5,184 – Rs. 1,500 = Rs. 3,684 which is 7.6% savings.

Bottom Line

Undoubtedly, there are lot of benefits of having an American Express card. If you are very excited to get it, check your availability and apply using my referral link given below. I will get few Rewards points, but there won’t be any extra charges for you. Rather, you will get waive-off on your joining fee and a special discounted annual fee from second year onwards.

Are you using American Express Rewards Credit Card? Feel free to share your experiences in the comments below.

![American Express Membership Rewards Credit Card: The Complete Review [2019]](https://urbancodex.com/wp-content/uploads/American-Express-Membership-Rewards-Credit-Card.png)

![HDFC Diners Club Black Credit Card: The Complete Review [2021]](https://urbancodex.com/wp-content/uploads/hdfc-diners-club-black-credit-card-300x188.png)

![Bank of Baroda Eterna Credit Card: The Complete Review [2021]](https://urbancodex.com/wp-content/uploads/bank-of-baroda-eterna-credit-card-300x188.png)

![Citi Cash Back Credit Card (India): The Complete Review [2019]](https://urbancodex.com/wp-content/uploads/Citi-Cash-Back-Credit-Card-300x189.png)

Useful information. Earning based on organise spending.

Good.