Buy now…pay later. This comes in our mind first when we talk about credit card and it’s benefits. The interest free credit for a certain period of time is the key feature why most of the people go for a credit card.

Some People Think Credit is Bad

Some people don’t like the idea of purchasing in credit. For them, credit is bad!

But like many others, I think “Credit is Good“.

Let’s say, you have Rs. 50,000 in your account. You have to purchase something of Rs. 40,000. There are two ways you can do it:

1. You use you account balance to pay for the purchase and are left with Rs. 10,000 in your account.

2. You buy in credit and settle the payment at a later point in time. So, you still have the entire Rs. 50,000 in your account.

Now, you can make better use of your money e.g. your money can be useful to give short-term loan to your friends or helping someone in need or use in case of emergencies. Remember, financial strength is big strength. If you have money in your account, then only you can do all these.

If the money is not utilized this way, at least you can earn some interest for keeping it in your bank account.

And, Some People Can’t Control Their Spends

The only other reason why some people don’t use credit card is they can’t control their spends and end-up overspending. If you also have this difficulty, then learn how to control credit card expenditures and stop overspending.

But, I Save Thousands of Rupees with It

If you make right use of your credit card, then you can save a lot of money with it. It really works! Read my case study to know how I save lacs of Rupees using credit card.

But saving is not the only benefit that comes with credit card. In this article I will discuss many other benefits of it. And you will learn, why it is important for you to have at least one credit card.

Most Important Benefits

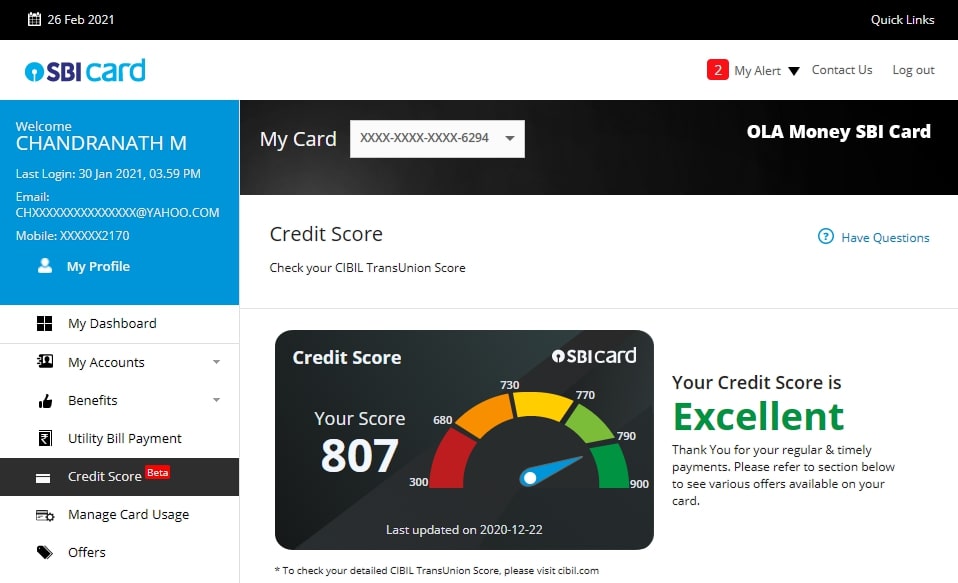

Credit Score

You can build a very good credit score with your credit card. All the payments towards your credit card bills count. So, if you make your payments on timely manner, it reflects to your credit score. This in turn helps you in longer run e.g. if you go for loans in the future. A good credit score holder can get a loan at a cheaper interest rate compared to one who doesn’t have a good score.

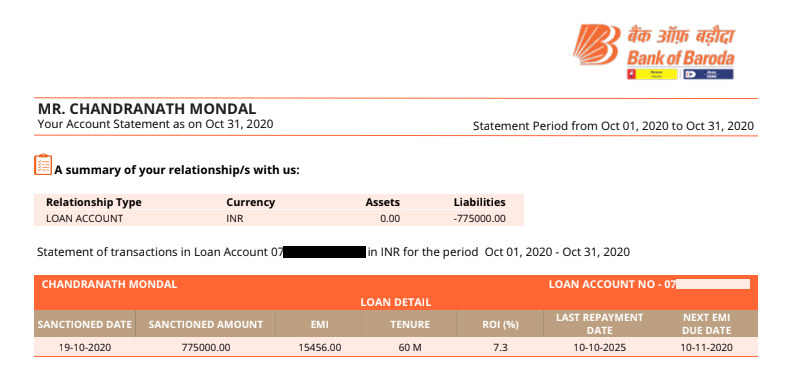

I got car loan @7.3% interest rate

Yes, you read that correct. While I have seen my friends are still paying interest rate @10.5% and more but I could make it @7.3%.

This was possible because my credit score is more than 800.

So, it’s no more a luxury. If you don’t use credit card and only use debit card or cash for all of your purchases then basically you are not making any score. Even if you earn a lot, but because you don’t have any credit report so you don’t have a credit score. This is the biggest reason why you must have at least one credit card.

Safety

Compared to debit card, if you loose your credit card then your risk is less. If somebody, who knows your card PIN, gains access to your debit card then a large money could be withdrawn. In case of credit card, normally you have very less cash limit and you can choose to control how much could be withdrawn.

In case of fraudulent transaction, you credit card company can reverse the transaction so that you don’t have to pay. This is one the best feature which your credit card company can offer.

Keeping Vendors Honest

Imagine you made a payment to your vendor for a service and later you want to dispute the charge for the faulty quality of the service. In that case, if you dispute the charge then there are mechanism where the card issuer can withhold the funds from the vendor. So, you will get your money back.

Interest-Free Credit

Generally you get 15 to 45 days interest free credit. So, for any of your purchases you actually get 15 to 45 days time to make the payment without any extra bucks. This is one the big reason why people opt for it. So, you get some time to arrange your money, if not immediately available. If it’s available, then you can earn little interest by keeping your money sitting idle in your bank account for those 15 to 45 days.

Grace Period

You get a pretty descent grace period (generally 15 to 20 days) to pay your bill without late fee after it gets generated. Occasionally if you request your credit card company to extend that for a month, they do that based on your past payment history and relationship.

Increased Purchase Power

You can make purchase of a large amount without having sufficient balance in your savings account. Later you can arrange the money and pay or your can opt for installment. This is one of the best reason why people love using it.

But this increased purchasing power sometimes make you spend more and you end-up overspending. I’ve written an exclusive article on how to control expenditure on your credit card and stop overspending.

Secure Alternative to Cash

You payments are recorded and it is easy to refer that later, if needed. This brings security when compared with cash transactions.

Emergency Cash

Good and bad, both times come in life. When you run out of your savings balance and need emergency cash, a credit card could be of great help. Though it affects your credit score and you need to pay high interest rate but still it could be a life saver depending upon the situation.

Deals

Signup Bonuses

Most credit card companies provide lucrative one time joining/signup bonus in terms of Rewards points/cashback or vouchers. You need to keep any eye on those offers to get that.

Reward Points

Most credit card offers Rewards points which gets credited to your a/c against your purchases. Depending upon the spend category, the Rewards points vary. These points can be redeemed across varieties of online and retail stores.

Cash Back

Similar to Rewards points, some credit card offers cash back for your spends and it varies depending upon the category. For example – you can earn 5% cashback on your utility bill payments and grocery purchases.

Discounts

From online shopping to offline dining restaurants, you will get plenty of good deals that are going on where you can save lot of money for using credit cards.

Making Life Easy

Equated Monthly Installments

You don’t need to apply for a loan for making a big purchase, rather you can use your credit card and pay the bill in EMI. Of course you need to pay interest rate but you will find lot of good deals in the market where you get 0% interest on EMI for using your credit card.

Add-on Credit Card

If you hold a credit card, you can extend the benefit to your family members by applying add-on cards. These cards normally come with no additional fees, and you get a consolidated bill for all your purchases across primary and add-on cards.

Utility Bill Payment

You can pay you monthly utility bills using your credit card. Not only you get good cashback or Rewards points, but also you can automate these payment procedure so that you don’t need to login to pay the bills every month. This really helps when there are multiple bills that need to pay every month, and specifically if on different dates.

Worldwide Acceptance

Normally credit cards are accepted worldwide so you don’t need to arrange different payment methods when travelling abroad.

Balance Transfer

You can transfer high interest credit amount to a low interest credit card. This affects your credit score but it can be a favorable method of paying down your credit card debt.

Draft or Cheque Issuance

Based on your credit limit, you get draft or cheque issuance from your credit card issuer. So, you don’t need to look for a third party and go through an approval process.

Online Accessibility

Most of the credit cards provide you a full suites of features to manage each and every detail like changing PIN, blocking/unblocking card, setting transaction limit, making payments etc. So, everything is on your finger-tip and you are in total control of your cards.

Tracking purchases

You get monthly statements of your credit card which helps you track your purchase and history. You also use that as records for future needs.

Premium Benefits

Premium credit cards comes with lot of additional benefits.

Golf Program

You can get free or discounted access to golf club/courses for holding any of the premium cards.

Lounge Access

Some cards give you free or discounted access to airport lounges.

Concierge Services

You can gain free access to plenty of concierge services for holding a premium credit card.

Insurance

Some insurance plans are only designed to certain credit card holders. So, if you hold any of such cards then you can opt for those specially designed insurance plans.

Frequent-Flyer Miles

On certain cards you can earn airmiles against your spends that can be redeemed for your air travels.

How did you find this article? Feel free to share your thoughts in the comments below.

![American Express Membership Rewards Credit Card: The Complete Review [2019]](https://urbancodex.com/wp-content/uploads/American-Express-Membership-Rewards-Credit-Card-300x190.png)

![HDFC Diners Club Black Credit Card: The Complete Review [2021]](https://urbancodex.com/wp-content/uploads/hdfc-diners-club-black-credit-card-300x188.png)

![Citi Rewards Credit Card (India): The Complete Review [2019]](https://urbancodex.com/wp-content/uploads/Citi-Rewards-Credit-Card-300x189.png)